tax avoidance vs tax evasion south africa

Tax avoidance tax evasion tax heavens illicit financial flows and global tax governance are real buzzwords that have come to dominate current international political and. Staff Writer 14 September 2021.

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tax Evasion is illegal.

. Basically tax avoidance is legal while tax evasion is not. A new criminal offence. Tackling offshore tax evasion.

There is not so much of a fine line between tax evasion. December 8 2021 Academic Journals 0. Strategies against tax evasion and tax.

The difference between tax avoidance and tax evasion boils down to the element of concealing. The South African GAAR is aimed at curbing impermissible tax avoidance arrangements that inter alia result in tax benefits with the sole or main purpose to obtain that tax benefit. What is the difference between tax avoidance and tax evasion.

Other entities to avoid paying taxes in unlawful ways. Tax avoidance is the legal use of the provisions of the tax laws to ones advantage to reduce the amount of tax that is payable by means that are within the law. Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share September 14 2021 Steve Tillman 0 Comments There is not so much of a fine.

Tax Avoidance vs Tax Evasion in South Africa. GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property. Africa Africas problem with tax avoidance.

Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share. Every year African countries lose at least 50 billion in taxes more than the amount of foreign development aid. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

When tax avoidance strays into illegal territory it becomes tax evasion. Strengthening the Tax Avoidance Disclosure Regimes and. Three new consultations have been launched on the subject of tax evasion.

One is legally acceptable and the other is an offense. In order to answer this question one needs to consider the difference between permissible tax avoidance arrangements and impermissible tax avoidance arrangements as well as the. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts.

Tax Avoidance Differences between Tax Avoidance and Tax Evasion. Tax evasion often takes the form of under-reporting income either of an individual or. Taxpayers intentionally falsifying or concealing the true condition of their activities to.

Tax evasion often involves. Tax Avoidance Differences between Tax Avoidance and Tax Evasion. The fight against tax evasion in South Africa is an ongoing battle.

Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce. In tax avoidance you structure your affairs to. As a South African you will pay a substantial proportion of your income and the money you spend to SARS as tax.

It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in. Tax Evasion vs. Modes of tax evasion and avoidance in developing countries 19 5.

The taxman in order. The tools available to law enforcement boil down to legislation and the enforcement thereof. There is a clear-cut difference between tax avoidance and tax evasion.

Tax evasion on the other hand refers to efforts by people businesses trusts and. Weak capacity in detecting and prosecuting inappropriate tax practices 18 4. Tax Avoidance is legal.

Introduction to personal income tax. SA Budget 2022 The BEPS Project. There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga.

Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a. What is tax evasion.

South African Regulator Explains Why It Has Been Targeting Global Crypto Exchanges Jackofalltechs Com

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

South Africa Sets Up High Net Worth Tax Unit International Adviser

Tackle Tax Evasion To Fuel Africa S Development

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Full Article Corporate Effective Tax Rates An Exploratory Study Of South African Listed Firms

Pdf Towards Improving South Africa S Legislation On Tax Evasion A Comparison Of Legislation On Tax Evasion Of The Usa Uk Australia And South Africa

South Africa Fatca Crs Compliance What Do I Need To Know

South Africa Tax Treaty International Tax Treaty Freeman Law

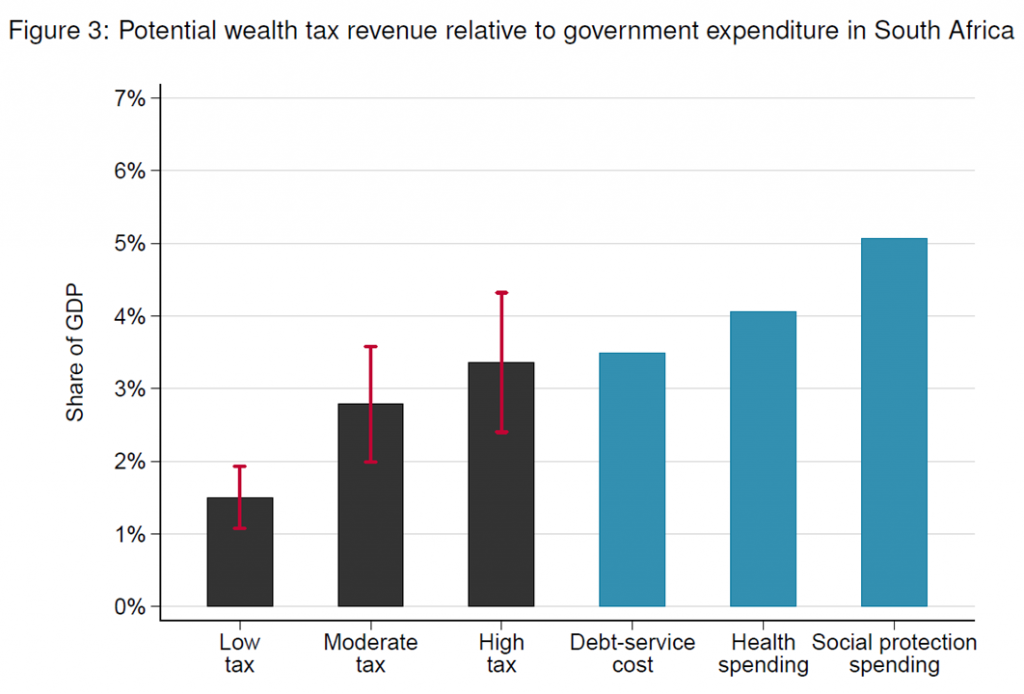

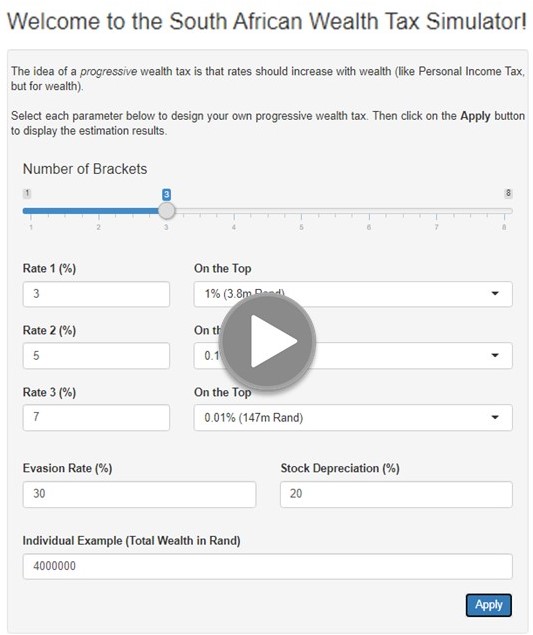

A Wealth Tax For South Africa Wid World Inequality Database

Tax Havens And Evasions Code For South Africa

The State Of Tax And Wage Evasion In South Africa

Pdf Revenue Approaches To Income Tax Evasion A Comparative Study Of Ireland And South Africa

Whistleblowers And Tax Evasion What South Africa Needs To Add To Its Toolbox

Average Real Gdp And Tax Burden In South Africa And Nigeria Download Scientific Diagram

Guest Blog Tax Avoidance And Evasion In Africa Tax Justice Network

South Africa S Next President Is Entangled In Another Corporate Tax Dodging Allegation This Time Its With Mtn Quartz Africa

Chipper Cash Extends Peer To Peer Money Transfer Service To South Africa Jackofalltechs Com