single life annuity pension calculator

Whether you agreed to a structured settlement to resolve a personal injury medical malpractice or wrongful death lawsuit or you inherited a structured settlement from a loved one this calculator can estimate the current cash value of your future payments. What is an Annuity Income Rider or Guaranteed Lifetime Withdrawal Benefit.

How We Calculate Your Pension College College

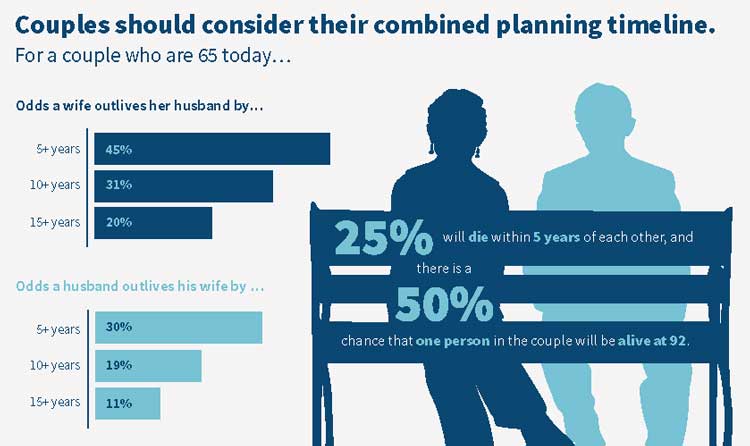

Similar to type 3 payments are guaranteed for as long as one or both of the annuitants are living.

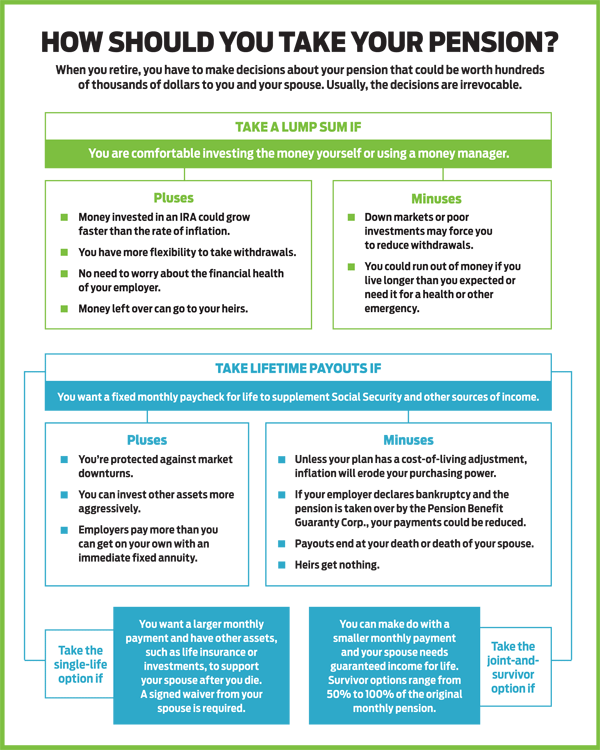

. A structured settlement is a negotiated arrangement whereby an injured party in a court case receives a settlement as a. Life or Last Survivor with 50 or 100 of the income and Refund of capital. A single-life pension means the employer will pay their employees pension until their death.

Less common qualified retirement plans include defined benefit pension plans 403bs similar to 401ks Keogh Plans Thrift Savings Plans TSPs and Simplified Employee Pensions SEPs. Sometimes this type is referred to as a Certain and Continuous annuity. Please visit our Annuity Calculator or Annuity Payout Calculator for more information or to do calculations involving.

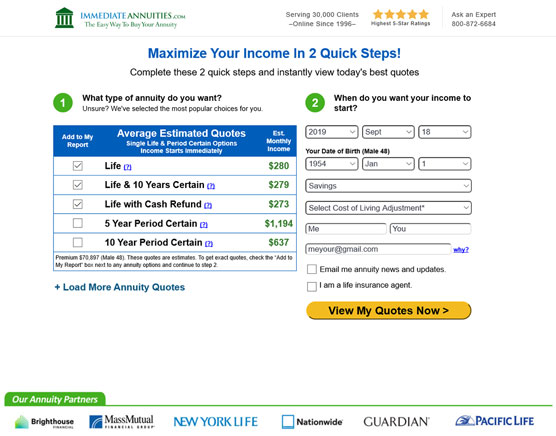

To offset this risk insurance companies charge fees for investment management contract riders and other administrative services. Life or Last Survivor with 50 or 100 of the income. SPIAs have been sold in the United States for hundreds of years and are still the best personal pension plan for lifetime income if you need those payments to start immediately.

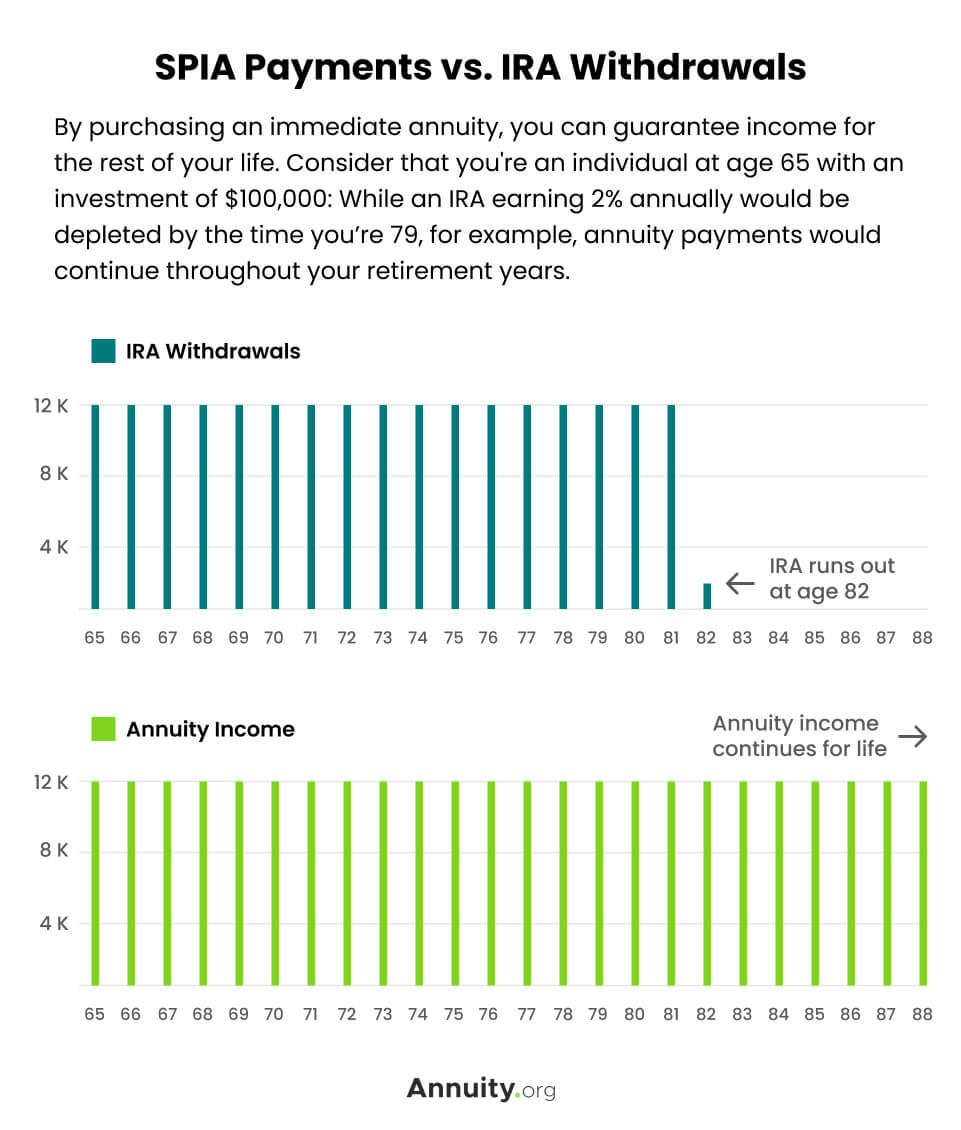

Get a guaranteed income for life. If a 65-year-old man invests 100000 in a single life annuity for instance he will immediately start earning 6or about 6000 per year for the rest of his life. Our Pension Lump Sum Tax Calculator has been designed to help you understand what you may receive from your Phoenix Life Individual Pension Policy if you took all your pension savings as a cash.

With this individual pension plan get Annuity options Health wallet benefit add-on Death Benefit Guaranteed Additions Multiple riders. That may not sound like a lot. Annuity contracts transfer all the risk of a down market to the insurance company.

The policyholder of this SBI pension plan may avail advance annuity payouts in compliance with certain terms and conditions. The new single-tier state pension from 6 April 2016 How much will my state pension be. To have ample retirement savings you need to buy the pension plan early in your work life.

However its still higher than the 4 percent withdrawals that most advisors urge people not to exceed in order to prevent outliving their nest egg. Fortune Guarantee Pension Plan from Tata AIA is a guaranteed pension plan that assures regular pension after your post-retirement life. This will make sure you have ample time to make small investments so that you can save a large amount.

If you would like. This means you the annuity owner are protected from market risk and longevity risk that is the risk of outliving your money. Immediate and Deferred Life Annuity with Return of Purchase Price Single and Joint life option.

Like type 1 above payments would only end on the passing of the last annuitant after the certain period. Premium payment period When buying a pension plan from a life insurance company get a sense of the time till which you will need to make the premium. Single Life or Joint Life Annuity with Refund.

This payment option offers a higher payment per month but will not continue paying benefits to a spouse who outlives the retiree. Below are the 4 annuity types that you can shop to find the best contractual offers to meet your financial goals. National Life Insurance Company and Life Insurance Company of the Southwest both members of National Life Group offer various types of annuities each designed to help meet specific personal and business needs and objectives.

Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. The annuity income rider is an optional benefit that functions like a pension in that the rider will distribute a guaranteed income for life to a retiree. Immediate Life Annuity Option Single and Joint life option.

Surrender Value shall be equal to the Present Value PV of expected future benefits discounted at the then prevailing interest 2. The income rider is typically an optional feature on fixed indexed and variable annuities and serves as an alternative to annuitization. The annuity payouts under the second option of joint life annuity include.

Single Premium Immediate Annuity Spia Rates Pros Cons

Joint And Survivor Annuity The Benefits And Disadvantages

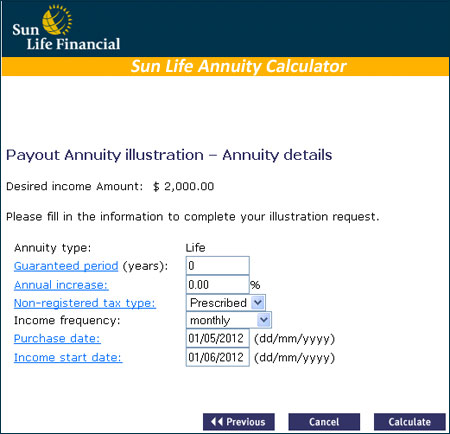

Sun Life Annuity Calculator Calculate Your Annuity Income Lifeannuities Com

The Best Annuity Calculator 17 Retirement Planning Tools

Calculating Pv Of Annuity In Excel

Annuity Buy Best Annuity Plans Of 2022 How It Works

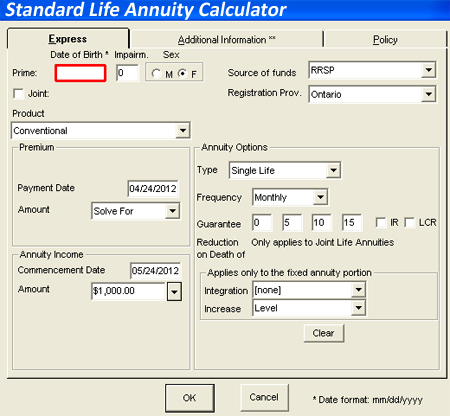

Standard Life Annuity Calculator Calculate Your Annuity Quote Using A Standard Life Annuities Calculator Lifeannuities Com

Life Expectancy Calculator Immediateannuities Com

Annuity Calculator Calculate Annuity Value Online In India

Pension Vs Annuity Top 7 Differences You Should Know

Annuity Formula Calculation Examples With Excel Template

Annuity Buy Best Annuity Plans Of 2022 How It Works

Present Value Of An Annuity How To Calculate Examples

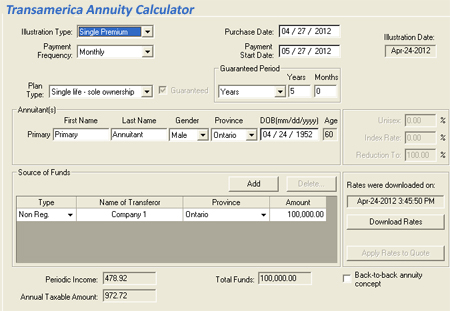

Transamerica Annuity Calculator Calculate Your Annuity Quote Using A Transamerica Annuities Calculator Lifeannuities Com

Annuity Taxation How Various Annuities Are Taxed

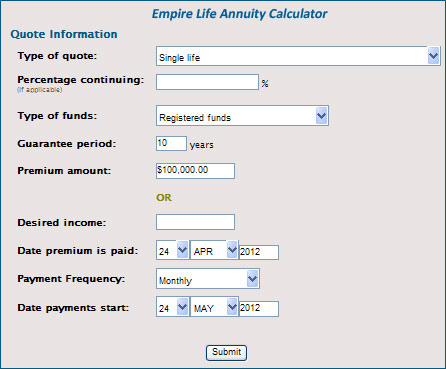

Empire Life Annuity Calculator Calculate Your Annuity Income Lifeannuities Com